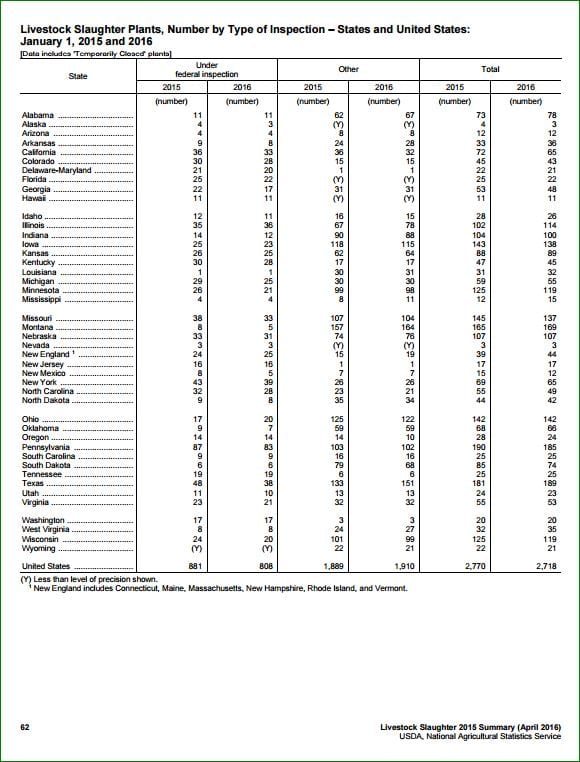

On April 20, 2016, USDA’s National Agricultural Statistics Service (NASS) published its 2015 Livestock Slaughter Summary; the data indicates further deterioration of U.S. slaughterhouse infrastructure. The total number of livestock slaughter plants (poultry plants are not included) under federal inspection declined from 881 to 808 between January 1, 2015 and January 1, 2016. There was a slight increase in the number of state-inspected/custom slaughter plants combined but not enough to offset the decline in the number of federal facilities. The total number of slaughter plants declined from 2,770 to 2,718.

The table below shows a breakdown into two categories of slaughter plants: those “under federal inspection” and those counted under “other” which covers facilities under state inspection and custom slaughter plants. The notation “(Y)” in the NASS table means zero; for example, there is not a single federally inspected slaughterhouse in the state of Wyoming.

Source: National Agricultural Statistics Service. Livestock Slaughter 2014 Summary, p. 62 (2015). Accessible via LINK at http://usda.mannlib.cornell.edu/MannUsda/viewDocumentInfo.do?documentID=1097 [.jpg]

Meat from a state inspected facility can be sold only within the state where the slaughter takes place, whereas, federal law currently prohibits the sale of any custom slaughtered meats. A list of those states with their own state meat inspection program is indicated in the “Inspection” column, meaning that an inspector must perform both an antemortem and a postmortem inspection of the animal and be present while it is being slaughtered.

Below is a chart listing the 27 states that have their own state meat inspection programs. Federally-inspected meat can be sold across state lines. Meat from a state-inspected facility can be sold only within the state where the slaughter takes place but federal law currently prohibits the sale of any custom slaughtered meats.

The latest NASS data shows more than ever why Congress needs to pass H.R. 3187, the Processing Revival and Intrastate Meat Exemption Act (the PRIME Act). Passage of the PRIME Act would give states the option to pass laws allowing the sale of custom processed meat—a particularly important step in those states that do not have their own inspection program. HR 3187 could also help producers meet the growing demand for value-added meat products. Under current law additional processing such as cooking, smoking and curing is required to be done at a USDA processing facility if any producers want to sell their products to restaurants, retail stores or other wholesale customers. The bill would give states the option of allowing intrastate wholesale transactions in these processed products without the requirement that the additional processing occur at a USDA (or state inspected) facility.

WHAT YOU CAN DO

Has your U.S. Representative signed on as a co-sponsor of HR 3187? Click here to see. If not, please Take Action. Call today and ask your U.S. Representative to co-sponsor HR 3187! You can find out who represents you by going to www.house.gov or by calling the Capitol Switchboard at 202-224-3121.

Spread the word about H.R. 3187!

Share this link: http://bit.ly/PRIME-ACT

Click here to print white paper as a 2-sided handout

Source: USDA-FSIS. States Operating their Own MPI Programs. Last modified 3/23/2015. http://www.fsis.usda.gov/wps/portal/fsis/topics/inspection/state-inspection-programs/state-inspection-and-cooperative-agreements/states-operating-their-own-mpi-programs [.jpg]

Source: USDA-FSIS. States Operating their Own MPI Programs. Last modified 3/23/2015. http://www.fsis.usda.gov/wps/portal/fsis/topics/inspection/state-inspection-programs/state-inspection-and-cooperative-agreements/states-operating-their-own-mpi-programs [.jpg]

YOUR FUND AT WORK

Services provided by the Farm-to-Consumer Legal Defense Fund (FTCLDF) go beyond providing legal representation for members in court cases.

Services provided by the Farm-to-Consumer Legal Defense Fund (FTCLDF) go beyond providing legal representation for members in court cases.

Educational and Political Action Services also provide an avenue for FTCLDF to build grassroots activism to create the most favorable regulatory climate possible. In addition to advising on bill language, FTCLDF supports favorable legislation via action alerts, social media outreach, and the online petition service.

You can help FTCLDF by becoming a member or donating today.

Anyone wanting to make a contribution to support the work of FTCLDF can make a donation online or send a check to:

Anyone wanting to make a contribution to support the work of FTCLDF can make a donation online or send a check to:

FTCLDF

8116 Arlington Blvd, # 263

Falls Church, VA 22042

Prefer to make a tax-deductible donation? Donate online at bit.ly/NFG4FTC.

You may also contact us by email at [email protected] or call 703-208-FARM (3276). Thanks for your support.